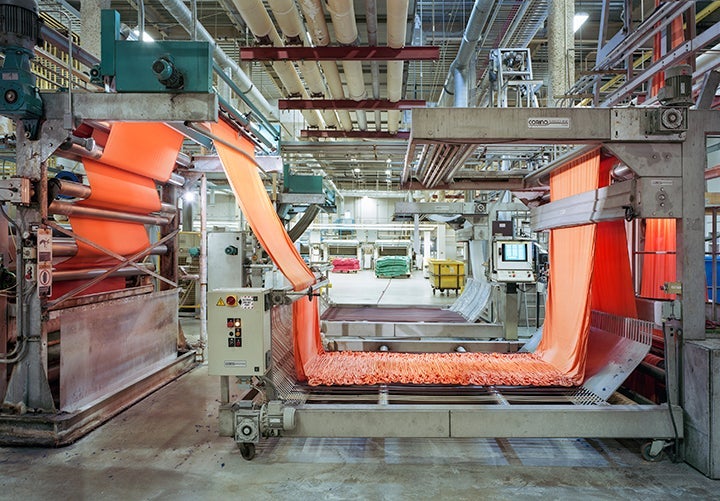

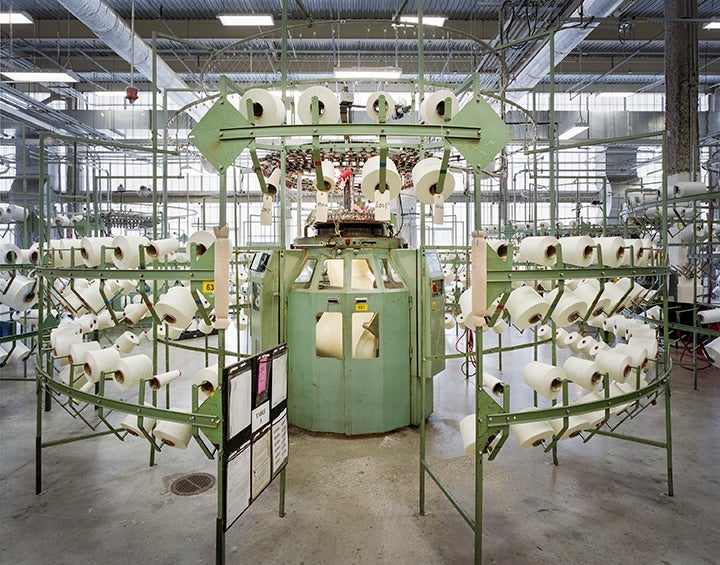

The history of what is now outdoor clothing fabric manufacturer Polartec is essentially a tale of two companies.

Long known as Malden Mills, the Massachusetts company revolutionized the outdoor industry by inventing synthetic fleece, but it also stumbled financially and endured a major fire before being bought by a private equity firm that changed its name to Polartec.

Now that private equity company is making another change by moving the company’s manufacturing operations from Massachusetts to Tennessee, closing a chapter on one of the most storied of New England’s textile mills and leaving a wake of disgruntled union workers.

Polartec CEO Gary Smith defended the exit from the factory in Lawrence, Massachusetts as a business decision necessary to keep the company competitive.

Meanwhile, negotiations with union workers in Massachusetts—who have protested the company’s exit and have tried to interest Patagonia in buying Polartec—have been contentious, although the two sides have recently come to terms. The closing Lawrence factory is losing 400 jobs, while the plant in Tennessee will employ more than 200 workers.

The decision to exit the Lawrence factory, which has been home to what is now Polartec since being rebuilt after a 1995 fire, came amid many factors. Among them, energy costs in Massachusetts are high relative to the rest of the United States, and the plant itself is much too large, Smith said. At its most productive, Polartec has only been able to utilize 25 percent of the plant’s capacity, making it cost ineffective.

The size and configuration of the factory had caused the company to struggle since before private equity firm Versa Capital Management, then known as Chrysalis Capital Partners, bought the company out of bankruptcy in 2007 and renamed it Polartec, Smith said.

The Lawrence factory that reopened after the fire, “was overbuilt to begin with,” Smith said. And by the mid-1990s, there was formidable competition for double-sided fleece from other producers, including those overseas. After years on the market, the fabric that Malden Mills invented had become commoditized.

The company can’t just downsize the plant and only use a fourth of it because it isn’t configured that way, Smith said. He compares it to a house; if someone wanted to only use 25 percent of the house, that would mean the kitchen and bathroom would all have to be moved to that section. The cost of doing the equivalent with the factory is prohibitive, he said.

“All in, it’s hard to make a case to stay here,” he said. Polartec plans to eventually sell the buildings.

Negotiations with the Union

The union—which now represents a little over 100 Lawrence workers, down from about 350 before the announcement the plant would move—views the relocation as a bid for cheaper labor.

But Smith said the decision isn’t so much about cost savings as it is about flexibility of the workforce. Workers at the Tennessee mill are cross-trained on different machines, an advantage Massachusetts union workers do not have, he said. Wage rates for the same jobs in Tennessee are similar to Massachusetts wages, Smith said.

Although he couldn’t give actual labor costs for the company, and he admits that hiring over a hundred newer workers has brought down the average wage, he says labor is not a material difference. “It’s not a cheap labor play,” he said. Rather, the non-union workers in Tennessee are more productive per hour, he said.

Ethan Snow, chief of staff and political director for the New England Joint Board Unite Here, the union representing the Polartec Lawrence-based hourly production employees, contends that the health insurance, retirement plans, holidays, and sick leave the union has negotiated over the years make the Massachusetts workers more expensive, meaning the company will save money on labor by the move to Tennessee.

The union wanted at least a week severance for every year of service, but the company only offered four weeks severance, an offer the union rejected.

“It’s not that they don’t want it; it’s that they feel insulted,” said Eddie Quiles, president of the local branch of the union who has worked at the company since 1994. “If the company was going out of business or going bankrupt we would understand. But this company is doing well. Why couldn’t they do a little better?”

In the end, the union ended up getting a better offer, with Polartec offering eight weeks of severance to those who have been laid off or will be and nine weeks for those with 20 years of experience.

The Polartec union’s contract was set to expire at the end of October, so the company was accelerating the shutdown of the Lawrence plant and planning to keep a non-union crew on site to wind down operations, Smith said. But as part of the negotiations, the union agreed to a contract extension.

“Gaining the breathing room with the union certainly helps,” Smith said.

A Fire and Financial Woes in a Different Time

The current relationship with Smith and Polartec is a far cry from what some long-term employees remember.

The 1995 blaze that came to be one of the defining moments in the company’s history and that propelled then-CEO Aaron Feuerstein to corporate sainthood in the public eye started not in the Lawrence factory’s fleece segment, but it the part used to make flocking, which is used in upholstery.

“There were people crying as the walls were collapsing,” said Quiles, who lives in Lawrence.

He recalls Feuerstein coming to the scene and comforting workers. The next day, Feuerstein told them he would continue to pay them while the mill was rebuilt.

“We were very happy (with) this gracious CEO who had shown compassion,” he said. “None of it was about corporate greed.”

But once the smoke cleared, Feuerstein’s compassion was not enough to keep the company healthy. In 2001, it filed for its second bankruptcy. (The first was in 1981.) Nor did the company’s financial troubles end after Feuerstein was replaced as CEO. It filed for protection against its creditors again in 2007

In a recent phone conversation, the 90-year old Feuerstein said Polartec’s move to Tennessee is a “disgrace.” Versa “didn’t consider the workers,” he said.

“These people are only interested in making profit,” he said. “They have no interest in the welfare of workers. I considered workers stakeholders in the business.”

Versa declined to comment for this article.

Moving Forward

Last fall, Polartec acquired United Knitting, in Cleveland, Tennessee, giving the Massachusetts company a new facility with only about a quarter of the capacity of the Lawrence factory.

Polartec has been upgrading the Tennessee facility’s utilities and infrastructure, and the ramp up was about 80 percent complete as of October 17, Smith said.

During peak production, the Tennessee factory will be 100 percent utilized, he said.

The company won’t export union jobs from Massachusetts to the non-union facility in Tennessee, and the loss of the Lawrence plant—one of the last vestiges of the once-great New England textile industry—has upset workers.

In June 2016, they went so far as to send a letter to Patagonia’s CEO Rose Marcario asking the company, “already a major purchaser of Polartec’s products, to buy Polartec and continue operations in Lawrence.”

The union didn’t hear back from Patagonia, Snow said. Patagonia representatives did not return a request for comment for this article.

But Smith said it wouldn’t make sense for Patagonia to buy Polartec because the California-based company doesn’t do its own manufacturing. “They never have been and never will be in the business of making things,” he said.

The downsizing of manufacturing is part of Versa’s exit strategy for Polartec, but the changes shouldn’t be blamed on the private equity firm that specializes in buying already distressed assets and trying to turn them around, Smith said.

“(Versa) didn’t put (Polartec) into distress; they bought it out of distress,” he said, adding that without Versa, the jobs being lost now would have been lost a decade ago. “(Versa) buys things that are broken and bleeding.”

Because Polartec is in a private equity portfolio, that means that by definition it is for sale. But the company is not actively pursuing a transition at the moment and doesn’t have an investment bank representing it for sale, Smith said.

Companies such as 3M and Invista would make more sense as logical purchasers for Polartec, and they have expressed interest in the past, he said. There are also some Asian companies that could be a logical fit, he said.

Regardless, it is unlikely that any so-called strategic buyer—operating companies rather than investment companies such as private equity—would touch Polartec if the Lawrence factory were still operating, Smith said.

No strategic buyer wants to buy the plant and close it down themselves because of the high emotions tied to it, he says. But “somebody has to do it,” he said.

Fleece Is Not Dead

Over his more than three years as CEO of Polartec, Smith has focused on diversifying the company.

When he inherited Polartec, the business was well represented in traditional outdoor brands but not in fitness and lifestyle products, he said. Over the last decade, it had also become too dependent on outdoor and military sales, he added.

Smith said the boom in down and lofted synthetic insulation hasn’t hurt the fleece market. “There is this misnomer in the outdoor space that fleece is dead,” he said.

While fleece is being sold less as a fabric for technical outdoor wear these days, he says there is more fleece being sold in general than ever before.

Fleece has a much broader market than puffy insulation because of its versatility and its fashion aspect, said Kathy Swantko, president and founder of FabricLink Network, a textile, fiber, and fabric networking, marketing, and education business.

Fleece can be printed, made to different lofts, made with blended fabrics and fibers, and made into specialty fabrics like fleece Spandex, she said. It’s also less expensive than lofted insulation and can be sold more easily in Targets and Wal-Marts.

The fabric has crossed over from the outdoor market to more fashion markets, and even the classic outdoor fleeces such as high-loft varieties are making a comeback driven by Millennials, who weren’t active purchasers when those products were first in their heyday, she said.

Optimism About Polartec’s Future

These days, Smith is pleased with how the company has penetrated the cycling market, with Polartec fabric in cycling brands including Sportful, Rapha and Giro. On the fitness side, Adidas’ Terrex outdoor product line has also added to Polartec’s growth, he said.

The diversification is due to new fabric innovations as well as pushing existing fabrics into different markets, he said.

Continued innovation is everything to Polartec, he added. There are a lot of companies that can make a fabric, but there is little global capacity for actually creating a fabric, which involves significant investment, he said. Polartec has more than 50 full-time engineers, technicians, and chemists dedicated to product creation.

The company now also has very little debt, he said. If it is successful in selling the Lawrence property when the transition to Tennessee is complete, the company will be debt-free, he said.

Polartec’s headquarters and research and development operations will remain in Massachusetts a few miles from Lawrence, with 100 jobs staying in the state, including management, finance, human resources, and product development positions, Smith said. The company also has operations in New Hampshire and China.

“The company is… a turtle that’s very healthy,” said Smith. “It’s just been carrying a shell that’s way too big. The turtle can’t keep dragging this [factory] around.”