Successfully producing outdoor gear used to be such a simple endeavor: make great product, then sell it through retail partners, or directly through a catalog or your own store. These days, the formula has become a lot more complicated. With the option to distribute through a suite of channels—specialty retailers, big-box retailers, directly to consumers via ecommerce and/or your own storefronts, through Amazon’s vendor central or Amazon resellers—brands must pull off a delicate balancing act and juggle a network of relationships to get their gear into customers’ hands. The good news? This swirl of channels also presents an opportunity to reach consumers wherever they are, telling a vibrant brand story while enhancing the shopping experience like never before. Over the next few weeks, OBJ will take a closer look at best practices for vendors in an increasingly omnichannel world.

The Challenge: Preventing Channel Conflict

Maintaining multiple distribution branches of a business comes with at least one significant pitfall: the tendency for the direct-to-consumer side to view the wholesale side as a competitor, setting up a classic channel conflict trap that too many vendors fall for, said Locally founder and Massey’s Outfitters owner Mike Massey. He’s seen instances of DTC or web teams actively trying to steal sales from the wholesale side of the business. Sometimes it’s subtle, such as designers burying a website’s dealer locator tool; other times, it’s as aggressive as pushing a DTC-only discount, surprising the retail side of the business and violating the brand’s own MAP policy in the process. But when a brand views sales across channels as a zero-sum game, everybody loses.

For one, trying to undercut the wholesale business for short-term gains will piss off retail partners, damaging the crucial relationships a brand needs to reach shoppers. Besides, customers don’t necessarily want to buy from a brand’s website. According to 2017 Census Bureau data, ecommerce accounted for just 10 percent of total retail sales. Rather than trying to pressure a potential consumer to buy online, argued Kristin Carpenter-Ogden, founder of Verde Brand Communications and host of its Channel Mastery podcast, it’s better to present all the options and make it easy for shoppers to choose their favorite.

Ultimately, internal catfighting actually harms sales. “Brands seem to have trouble juggling two balls at once—[they think] either you’re successful in wholesale or you’re successful in direct,” said Rich Hill, president of Grassroots Outdoor Alliance. “But across all our brands, the ones that are truly successful are successful in both. Overall, the brands that are taking this either/or approach are failing, not growing.”

The root of the problem lies in brand organization and leadership, argued Christian Gennerman, VP merchandising and strategy at the 180 Commerce consulting firm. “The biggest mistake is having someone overseeing their wholesale business and someone else overseeing their DTC business,” he said. “Each person in charge of that silo is bonused based on the [sales] they create in that channel. But they need to align goals at the highest level.”

The Fix

Move away from compartmentalized units within the brand in favor of communication and teamwork. This is best done when a high-level employee makes it his/her job to oversee total business growth, not just an individual channel’s numbers.

Overall, brands need to abandon short-term, margins-based strategies for a more holistic, customer-centric approach. “You have to evolve so that you’re thinking more about the customer experience than you are about having one channel win over the other,” noted Carpenter-Ogden.

The Strategy

Squashing channel conflict involves enhancing communication and shaking things up internally.

>> Appoint a “Fork” “When I look across brands that have a true multichannel strategy, all of the sales channels report to a single individual,” Hill said. “We lovingly call this person ‘the Fork.’” The Fork’s job is to help manage internal policies and investments for big-picture success, growing the entire business rather than just one slice of it. “Where the Fork doesn’t exist, I’ve seen a battle for messaging, for resources, and for inventory. Those are the brands we see suffer in wholesale and direct.”

>> Change the bonus policy When bonuses depend on each segmented channel’s success, employees in those channels can get cutthroat. Instead, reward people based on the entire company’s success.

>> Get in the same room The heads of DTC, wholesale, online retailers, and any other distribution channels should meet regularly to talk strategy and messaging.

>> Talk early and often Avoid surprises between channels. It’s best for the DTC channel to stick closely to the brand’s MAP policy, said Gennerman. But if it must discount product, “There must be continuous communication between brands and retail partners. Say, ‘We’re going off-price early, but we’re not going for X amount of time because we want you to have first action on this.’”

Case Study: Patagonia

At Patagonia, keeping channel conflict in check comes down to one clear, overarching vision for the company, said VP of Wholesale Bruce Old: “You can’t tell a customer where to shop. The big piece here is what the customer wants out of the [shopping] experience. Whether they walk into one of our dealers or one of our company stores, or [visits] a dealer website or Patagonia.com, we want to make sure the experience is really good across all those channels.”

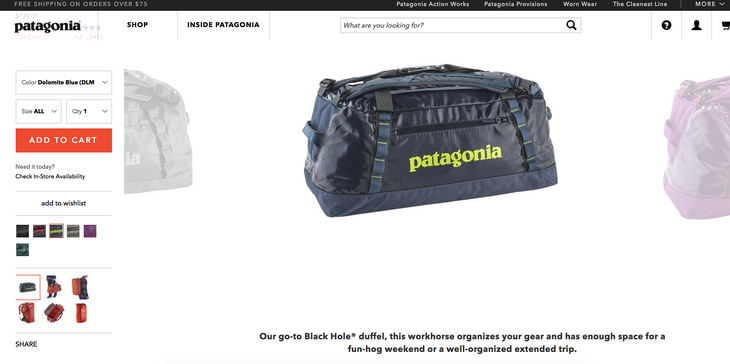

To hit that goal, the brand created their internal “omnichannel team” five years ago, and the leaders in all distribution channels meet monthly to hammer out strategy and keep the playing field level. One benefit: it allows channels to help, not hinder, each other. “The omnichannel team is data-driven, and we make sure that we share trends with our retailers,” Old said. For example, the team recently crunched the numbers from direct sales of Patagonia’s Black Hole luggage and passed them on to shops. “We try to say, ‘Hey, listen, we’re seeing buying in our direct channels increase by X amount, and they’re colors you, as a retailer, aren’t buying.’”

The team also gives retailers a direct voice with the brand’s higher-ups. After production issues forced Patagonia to drop a key product last fall, coupled with changes to the marketing calendar, it was left with messaging more focused on the direct business. “A lot of retailers called us out on it, and they were right,” Old said, adding that the brand has improved its coordination across the company as a result. And starting with Fall 2018, Patagonia shifted its seasonal buying and shipping schedules by 30 days to give retailers more time to order—a request communicated through omnichannel team meetings.

“We look at it from the perspective of, ‘How do we leverage the needs across all our channels for the greater good of the customer?’” Old said. “Not, ‘How is one channel going to meet their number versus another channel?’”