How good of an investment is the outdoor and recreation industry on Wall Street?

An ���ϳԹ��� Business Journal analysis shows the sector has outpaced broader market indices such as the S&P 500 and Dow Jones Industrial Average with healthy gains during the past five years, albeit still lagging behind the soaring tech industry.

OBJ compiled an index of 18 global outdoor recreation companies that trade on global exchanges (see chart), then averaged their performance over the past five years (from June 19, 2013 through June 19, 2018) to come up with our Outdoor Index. The results show a 82 percent gain for the sector, beating the S&P 500’s 65 percent gain and the DJIA’s 61 percent gain, during the same period.

In money terms, if you invested $1,000 in each of our 18 Outdoor Index stocks for a total of $18,000 five years ago, you could cash out those investments for $32,698 today—a gain of $14,698. This doesn’t include any dividends paid out by the stocks, which would increase those gains by varying degrees.

By the Numbers

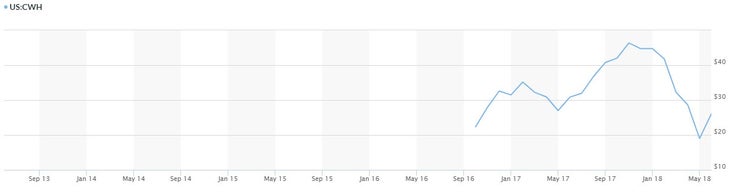

Camping World Holdings (Camping World, Uncle Dan’s)

Camping World Holdings Inc. (NYSE: CWH) went public in October 2016 and acquired Uncle Dan’s, Erehwon Mountain, and Rock Creek to boost its outdoor specialty retail business. Still, retail has been a challenge and the stock is up only 2.9 percent since its inception.

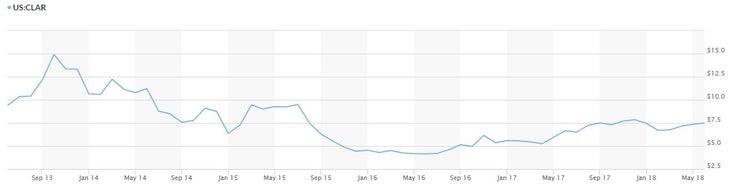

Clarus Corp. (Black Diamond)

Clarus Corp. (NASDAQ: CLAR), parent to Black Diamond, has had a rough go of it in the past five years, falling 18.9 percent amid its acquisitions then disposal of Gregory Mountain and Poc Sports, and departure of its CEO and BD founder Peter Metcalf.

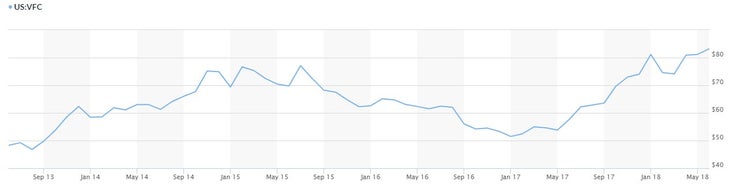

VF Corp. (TNF, Timberland, etc.)

VF Corp. (NYSE:VFC) grew its business to largely depend on outdoor sales with brands like The North Face, Timberland, Jansport, and Smartwool in its portfolio. Its stock is up 75.1 percent in the past five years.

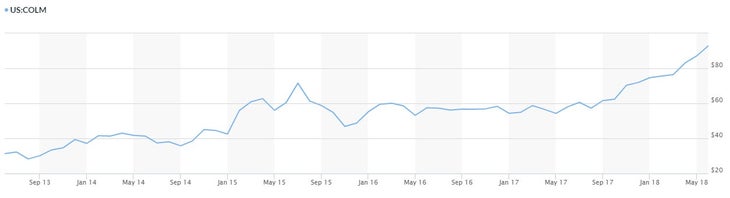

Columbia Sportswear Co. (Columbia, Mountain Hardwear, prAna)

Columbia Sportswear Co. (NASDAQ: COLM) saw its stock soar 199.7 percent thanks to its prAna acquisition, boosting its lifestyle business, while simultaneously benefiting from Columbia’s advances in apparel innovation during the past five years. A few bumpy years at its Mountain Hardwear brand was the only thing holding it back from even larger gains.

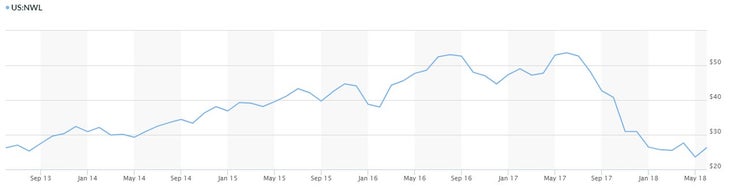

Newell Brands Inc. (Marmot, Coleman, etc.)

Newell Brands Inc. (NYSE:NWL) merged with Jarden Corp., parent to Marmot and Coleman, to become a $13 billion diversified conglomerate, but so far, that hasn’t helped its stock price, which has lagged behind the rest of the market, falling 2.7 percent in the past five years.

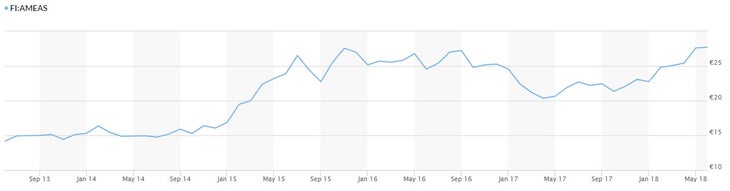

Amer Sports (Salomon, Arc’Teryx, Atomic, Suunto, etc.)

Amer Sports (HEL:AMEAS) has seen steady gains after a few rough winters. Key to its success—the stock is up 94.8 percent in five years—has been lifestyle push at Arc’teryx and Salomon, balancing the core side of the business.

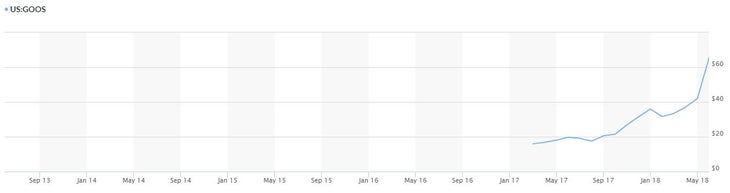

Canada Goose Holdings Inc.

Canada Goose Holdings Inc. (NYSE: GOOS) has been riding high on the fashion front. Its iconic look is in style with consumers and the stock is up 274.4 percent since going public in March 2017.

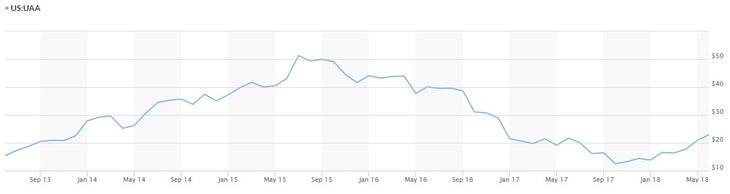

Under Armour Inc.

Under Armour Inc. (NYSE: UAA) has come off its recent highs after previous lofty outlooks on growth didn’t come through, including within the outdoor industry. That’s kept its stock price in check, lagging behind its biggest competitors Nike and Adidas.

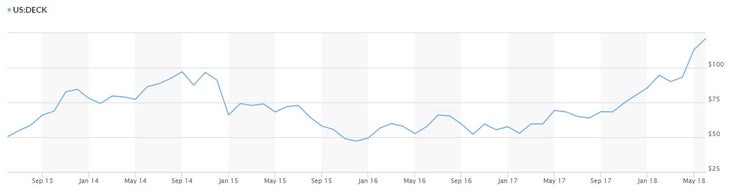

Deckers Outdoor Corp. (Teva, Hoka One One, etc.)

Deckers Outdoor Corp. (NYSE: DECK), parent to Teva and Hoka One One, has benefited from the athleisure trend in footwear. Meanwhile, trade deals and technology advances have cut the cost of footwear manufacturing, boosting its bottom lines.

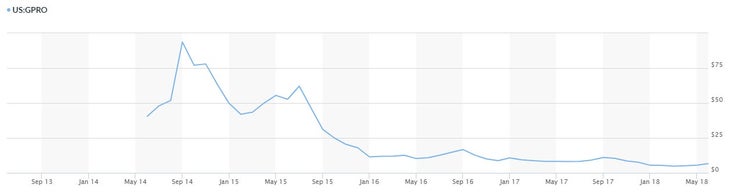

GoPro Inc.

GoPro Inc. (NASDAQ: GPRO) was a high-flying stock when it debuted in June 2014, but since then, more consumers are opting to capture video on their phones versus a separate camera. That’s hurt sales and the stock has plummeted 78.1 percent to date.

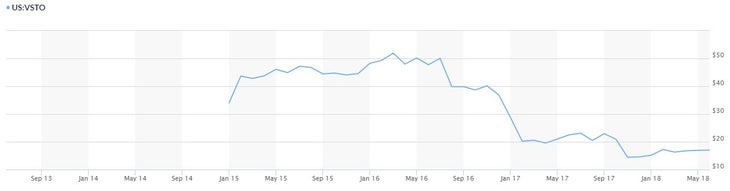

Vista Outdoor Inc. (CamelBak, Camp Chef, etc.)

Vista Outdoor Inc. (NYSE: VSTO) went public in February 2015 and then went on an outdoor acquisition spree to try diversify from its firearms business. It now owns CamelBak and Camp Chef, among others, but the diversification hasn’t made up for the drop in firearm sales post years of political gun-control debates. Its stock is down 55.3 percent over the past five years.

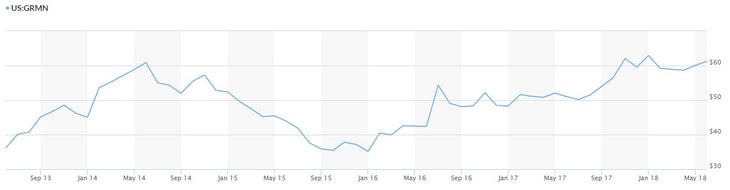

Garmin Ltd.

Garmin Ltd. (NASDAQ: GRMN) turned in perhaps the biggest surprise performance over the past five years. Despite the continuing declines of its auto GPS sales, the company saw a big boost from its fitness-and-outdoor tracking technologies, leading to a gain on Wall Street of 70.1 percent.

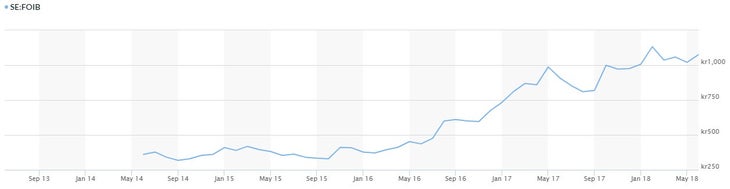

Fenix Outdoor International AG (Fjallraven, Brunton, Hanwag, etc.)

Fenix Outdoor International AG (STO: FOI-B) made the right choice expanding its brands, including Fjallraven, Brunton, and Hanwag, to the North American retail scene. They were a big hit and the stock is up 198.9 percent, despite more challenging markets in Europe.

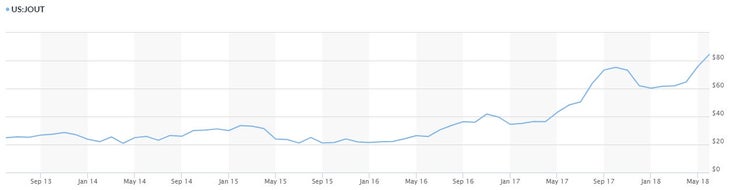

Johnson Outdoors Inc. (Eureka, JetBoil, etc.)

Johnson Outdoors Inc. (NASDAQ: JOUT) has had a solid business plan for its JetBoil acquisition, while maintaining Eureka as a top brand in the mass channels. Plus, the rise of SUPs and other paddlecraft has helped its watersports channels, all propelling the stock up 221.5 percent in the past five years.

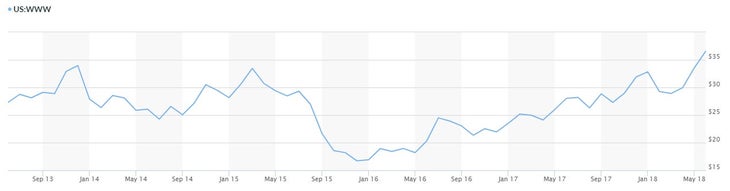

Wolverine World Wide, Inc. (Chaco, Merrell, etc.)

Wolverine World Wide, Inc. (NYSE:WWW), parent to Chaco, Merrell, and its namesake brand, hasn’t done much to excite Wall Street in the past five years, and while its stock is up 39.6 percent during the period, that gain has lagged the broader averages.

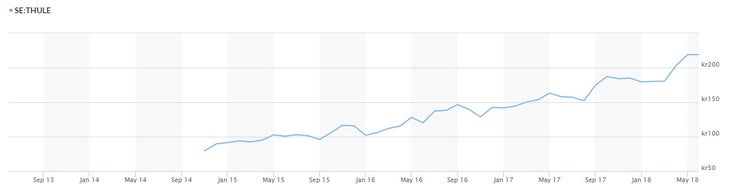

Thule Group AB

Thule Group AB (STO:THULE), has seen continued success from its vehicle rack business, while expanding into vehicle-top shelters and packs—a good fit for always-on-the-move millennials. Its stock price is up 174 percent since debuting on the public exchanges in November 2014.

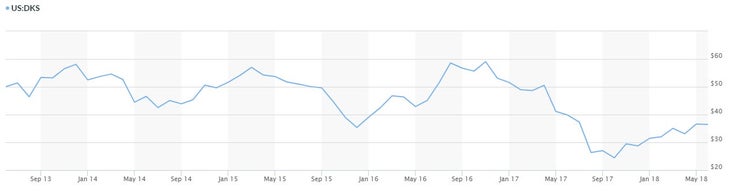

Dicks Sporting Goods Inc.

Dicks Sporting Goods Inc. (NYSE: DKS), like many other big-box retailers, has struggled in the face of increased online sales at Amazon on one end and specialty-retail competition on the other. However, despite its 30.2 percent decline in stock value over the past five years, it remains a survivor after competitors such as Sports Authority and Sport Chalet went out of business.

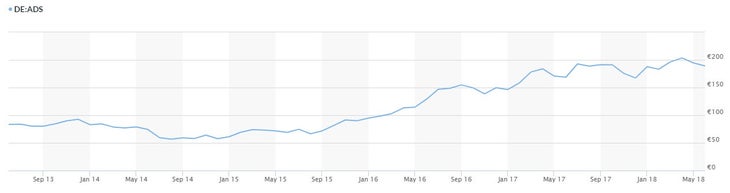

Adidas AG

Adidas AG (ETR:ADS) regained its mojo after a few rough years and the brand is back in style, firmly behind sportswear leader Nike. Its outdoor business continues to thrive as well and its stock price is up 128.3 percent in the past five years.

Biggest Movers

Like any investment portfolio, there were winners and losers on the Outdoor Index.

Leading the pack on the U.S. markets with triple-digit percentage gains were:

- Canada Goose Holdings Inc. (NYSE: GOOS +274%)

- Johnson Outdoors Inc. (NASDAQ: JOUT +222%)

- Columbia Sportswear Co. (NASDAQ: COLM +200%)

- Deckers Outdoor Corp. (NYSE: DECK +127%)

Meanwhile, the following European companies fared best on overseas exchanges:

- Adidas AG (ETR:ADS +128%)

- Fenix Outdoor International AG (STO: FOI-B +199%)

- Thule Group AB (STO: THULE +174%)

The top performers largely shared a common denominator by growing via acquisitions and market expansions. Johnson Outdoors (parent to Eureka Tents and a collection of paddlesports brands) acquired JetBoil; Columbia (parent to its namesake and Mountain Hardwear) bought prAna; and Deckers (parent to Teva and Ugg) added Sanuk and Hoka One One. In Europe, the key for Fenix (parent to Fjallraven, Hanwag, and Brunton) and Thule (which ventured into camping beyond its mainstay car racks) were expanded marketing and sales in United States.

Brands like Canada Goose, Columbia, adidas, Deckers, and Fenix also benefited in a big way from the popular athleisure fashion trends in the broader market during the past half decade, according to Nathan Pund, managing director at investment banking firm Houlihan Lokey.

“The outdoor customer has moved away from a hardcore brand to much more of an aspirational brand that they can wear in the city, too,” said Pund, who has focused on outdoor, active-lifestyle and tactical investments at various firms, including RBC Capital, Silver Steep Partners, D.A. Davidson and Lazard, since 2001. “Brands that provide apparel and footwear have fared better than those just focusing on equipment.”

But acquiring brands and pushing lifestyle gear hasn’t been a surefire bet for the industry.

Clarus Corp. (NASDAQ: CLAR -19%), parent to Black Diamond, had a rough go of it during the past five years, first acquiring a slew of outdoor brands, including Gregory and POC Sports, only to turn around and sell them and then see its iconic CEO Peter Metcalf leave the company.

Vista Outdoor Inc. (NYSE: VSTO -55%) also struggled, and its acquisitions of outdoor brands CamelBak and Camp Chef could not offset declines in its mainstay firearms businesses, which saw a boom and bust of business following the political and societal debates over gun control.

Fashion is also a tougher nut to crack for many outdoor brands, Pund noted. All of a sudden, that means competing within a much larger market with faster-moving trends. “If you’re on-trend, it can lead to great results,” he said, “but if you’re off trend, it’s a big challenge.” And outdoor brands can’t rely completely on fashion, he added—they have to maintain their roots. “The North Face [owned by (NYSE:VFC +75%)] is a good example,” he said. “They still put a lot effort into core outdoor product to maintain their authenticity.”

Evolving Retail

To no surprise, for any retailer not named Amazon, the past five years were challenging—Dicks Sporting Goods Inc. (NYSE: DKS -30%) and Camping World Holdings Inc. (NYSE: CWH +2.9%) both lagged.

“I think the breakdown of retail has been the biggest challenge,” Pund said, referring to recent bankruptcies and store closures across the retail spectrum from big-box to specialty retail, including Sports Authority, Sport Chalet, and Hudson Trail Outfitters, to name a few in the outdoor recreation space. “The historical way we shop has changed dramatically, and some brands have been better at adapting than others.”

He elaborated that the rise of Amazon and other online outlets such as Backcountry.com allowed consumers to bypass traditional brick-and-mortar retail to find the gear they wanted at more competitive prices. In addition, competition has come from direct-to-consumer channels, both online and through branded stores, where brands have benefited from higher margins and, perhaps more importantly, a deeper relationship with their customers via omni-channel strategies from targeted digital marketing to in-person, local events.

On the big-box front, retailers are looking for the same—a way to strengthen authentic relationships with shoppers, and that is likely the main driver behind Camping World’s acquisitions of specialty outdoor retailers Erehwon Mountain, Uncle Dan’s, and Rock Creek.

Tech Dominates

While our Outdoor Index kept pace with the broader S&P 500 and DJIA, its competition for investors on Wall Street is a familiar foe on the consumer front—the tech industry.

During the past five years, the tech-heavy NASDAQ Index rose 122 percent, outpacing the gains of the Outdoor Index. Going back to our example of an $18,000 investment, had you invested the same funds to follow the Nasdaq instead, you would have seen the investment rise to $52,560—a gain of $34,560.

Of course, this is just five years. The markets ebb and flow. Had one invested in the two indexes during, for example, the early 2000s, when the tech market crashed, then it’s likely the Outdoor Index outperformed. Plus, sometimes you want to put your money where your heart is and investing in the outdoors has been a decent deal.

Still, these past five years on the market paint a picture of what’s happening in the real world. People are spending more money on outdoor recreation…just not as much as they are spending on tech.

“I think tech will continue to outperform,” Pund said. “The question for the industry is what parts of tech can be integrated with the outdoors.”

Brands such as Garmin, for example, have benefited from the fitness-tracking angle (NASDAQ:aGRMN +70%), while GoPro (NASDAQ:GPRO -78%) has struggled to fully capture the video-capture market.

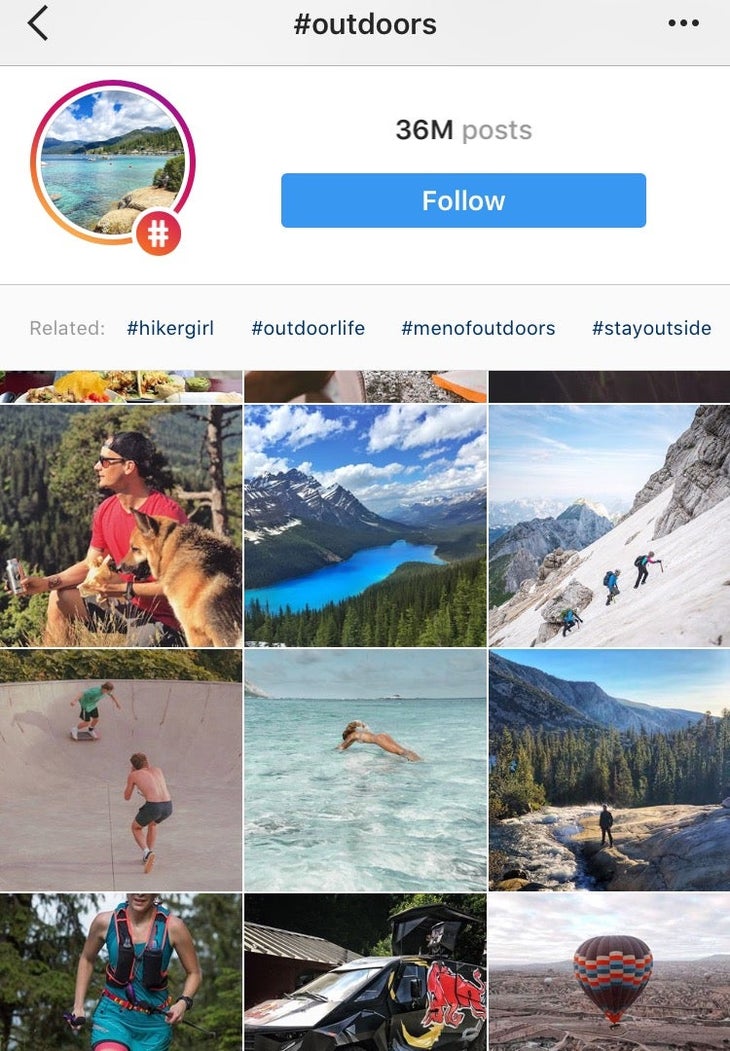

“Enjoying the outdoors has become much more about the experience and sharing that experience via tech and social media,” Pund said, “versus the idea of going outdoors to seek solitude.”

The Next Five Years

Looking ahead, Pund declined to pick any specific winners and losers on Wall Street—but says the industry as a whole will continue to do well.

“Millennials are very excited for the outdoors, just in a different way than their parents were,” he said. “In the past, it was about mastering the one or two sports…today it’s about experiencing a wider scope of recreation.” The companies that will do best, from Pund’s perspective, are those that will remain engaged with the customer through social media and e-commerce, and through live experiential events.

He also sees continued merger and acquisition activity among the larger outdoor brands on Wall Street. “The market has become so competitive that it’s faster to acquire than build on your own.”

The Breakdown

| Company | Price 5 or less years ago | Price as of June 19, 2018 | Percentage |

| *Camping World Holdings Inc (Camping World, Uncle Dan’s) – NYSE: CWH | 10/3/2016 23.75 | 6/19/2018 24.45 | +2.9% |

| Clarus Corp. (Black Diamond) – NASDAQ: CLAR | 6/19/2013 9.19 | 6/19/2018 7.45 | -18.9% |

| VF Corp. (TNF, Timberland, etc.) – NYSE: VFC | 6/19/2013 47.65 | 6/19/2018 81.7 | +75.1% |

| Columbia Sportswear Co. (Columbia, Mountain Hardwear, prAna) – NASDAQ: COLM | 6/19/2013 30.89 | 6/19/2018 92.59 | +199.7% |

| Newell Brands Inc. (Marmot, Coleman, etc.) – NYSE: NWL | 6/19/2013 27 | 6/19/2018 26.26 | -2.7% |

| Amer Sports (Salomon, Arc’Teryx, Atomic, Suunto, etc.) – HEL:AMEAS | 6/19/2013 13.81 | 6/19/2018 27.4 | +98.4% |

| *Canada Goose Holdings Inc. – NYSE: GOOS | 3/13/2017 18 | 6/19/2018 67.42 | +274.4% |

| Under Armour Inc. – NYSE: UAA | 6/19/2013 15.50 | 6/19/2018 22.62 | +45.9% |

| Deckers Outdoor Corp. (Teva, Hoka, etc.) – NYSE: DECK | 6/19/2013 53.18 | 6/19/2018 120.45 | +126.5% |

| *GoPro Inc. – NASDAQ: GPRO | 6/23/2014 28.65 | 6/19/2018 6.27 | -78.1% |

| *Vista Outdoor Inc. (CamelBak, Camp Chef, etc.) – NYSE: VSTO | 2/2/2015 38 | 6/19/2018 16.98 | -55.3% |

| Garmin Ltd. – NASDAQ: GRMN | 6/19/2013 35.82 | 6/19/2018 60.93 | +70.1% |

| *Fenix Outdoor International AG (Fjallraven, Brunton, Hanwag, etc.) – STO: FOI-B | 6/29/2014 358 | 6/19/2018 1070 | +198.9% |

| Johnson Outdoors Inc. (Eureka, JetBoil, etc.) – NASDAQ: JOUT | 6/19/2013 24.98 | 6/19/2018 80.3 | +221.5% |

| Wolverine World Wide, Inc. (Chaco, Merrell, etc.) – NYSE: WWW | 6/19/2013 26.33 | 6/19/2018 36.75 | +39.6% |

| *Thule Group AB – STO: THULE | 11/20/2014 80 | 6/19/2018 219.20 | +174% |

| Dick’s Sporting Goods Inc. – NYSE: DKS | 6/19/2013 52.01 | 6/19/2018 36.29 | -30.2% |

| Adidas AG – ETR:ADS | 6/19/2013 83.22 | 6/19/2018 189.95 | +128.3% |

*These companies went public less than five years ago, so their performance was calculated from their opening day on the market.

Outdoor Index – +81.6%

S&P 500 – +69.6%

DJIA – +61.3%

NASDAQ – +121.8%